The Unromantic Truth About Wedding Business

Food and Beverage is certainly one of the most important amenities in a private club, but it's also one of the most misunderstood in terms of its financial impact. Many boards get fixated on increasing F&B revenue as a solution to the club's financial woes. In particular, they focus on weddings and banquets, believing higher profit margins associated with those large events will produce the revenue boost they need.

Food and Beverage is certainly one of the most important amenities in a private club, but it's also one of the most misunderstood in terms of its financial impact. Many boards get fixated on increasing F&B revenue as a solution to the club's financial woes. In particular, they focus on weddings and banquets, believing higher profit margins associated with those large events will produce the revenue boost they need.

Like virtually every other decision club leaders must make, the positioning of F&B in the club is a choice. Should Food & Beverage be viewed as an amenity or as a profit center? To help us weigh those options, let's take a closer look at the impact of high-volume banquet business in an actual club.

Benchmark Study: In the quest to increase revenue, the true costs associated with high-volume banquet business—financial and otherwise—are sometimes overlooked. Case in point: A financially healthy, high-end country club with a positive net operating result and the physical capacity to handle very large events. The club had become a popular wedding venue—so much so that they were averaging about 50 weddings per year and demand showed no sign of slowing down. The for-profit club’s total banquet revenue was in the top 10 percent nationally and made up 43 percent of their F&B revenue vs. an industry median of 30 percent. While a club in this position might be tempted to look for ways to accommodate additional business, this club’s board and manager recognized the need for a careful cost/benefit analysis based on industry data.

The Downside: One of the most significant areas of concern for this particular club was member displacement. The volume of weddings was impacting members’ access to the clubhouse nearly every weekend. Over time, the members adapted by packing the club on Friday nights and avoiding it completely on Saturdays. Since a major component of the membership value equation is a feeling of privilege and privacy, the situation was less than ideal in terms of both member satisfaction and the club's ability to appeal to prospective members.

Another troubling issue for this club was the amount of management resources and energy consumed by the marketing, booking, and delivery of so many banquets. In addition, while the exact costs would be difficult to isolate, increased banquet traffic in the clubhouse was taking a toll on the facility itself, increasing housekeeping and maintenance expenses and potentially accelerating replacement cycles for banquet-related furniture, fixtures and equipment. The question this club's leaders were asking themselves was "is it worth it?"

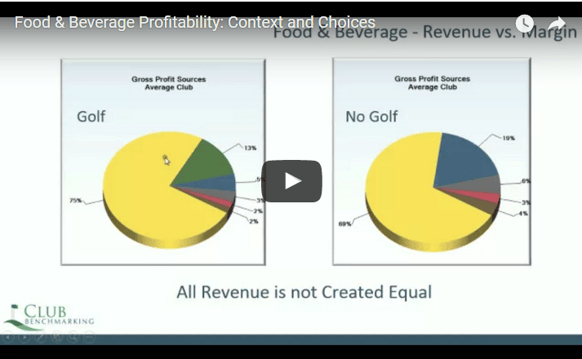

Financial Impact: The ratio of F&B Net Income/Loss as a Percentage of Gross Profit was used to determine the relative significance of the club's F&B operation to its overall financial health. In fact, for most clubs a full 80% of revenue comes from two items – Dues (50%) and F&B (30%). However from an impact perspective the dues revenue represents 80% of a clubs gross profit whereas F&B generate zero gross profit. This reinforces that clearly all revenue is not created equal in clubs. Industry data confirms that 75 percent of clubs lose money in F&B and this particular club was in the 81st percentile, so somewhat profitable in F&B. Still, despite all the volume and effort, the club’s F&B operation was producing just four percent (4%) of the club’s overall Gross Profit. For this particular club, that 4 percent equates to about $250,000 which begs the question: Could the same amount be generated through less intensive and invasive methods such as membership drives, outings or minor price adjustments?

The chart below summarizes F&B Net Income/Loss as a Percentage of Gross Profit for clubs with golf and clubs without golf.

F&B Net Income/Loss as a Percentage of Gross Profit

(based on National club industry data)

|

|

25th |

MEDIAN |

75th |

|

Clubs with Golf |

-9% | -4% | 0% |

|

Clubs w/no Golf |

-9% |

-2% |

+2% |

Conclusion: This case study reinforces what club industry data clearly reflects: F&B in the club industry is a vital amenity, but it is not a profit center. The benchmark data helped our case study club make a very important choice—to refine their banquet strategy in terms of “quality vs. quantity.” This club's leaders recognized that lifecycle gatherings such as birthdays, anniversaries and weddings are a high value amenity for their members and those events continue to be a key part of the club’s culture. Emphasis on “off the street” banquet revenue is greatly decreased and the club's leaders are now focused on a more balanced view of other sources of Gross Profit such as new member dues or golf operations revenue.

.png?width=200&height=58&name=MicrosoftTeams-image%20(8).png)